Depreciation Rate On Furniture As Per Companies Act . Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. A table is given below of depreciation. In this article we have compiled depreciation rates under companies act 2013 under. Web 127 rows ca sandeep kanoi. Web depreciation rates under the companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. Web 129 rows depreciation rates are not given under the new companies act. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. The companies act, 2013 provides depreciation rates for. The depreciable amount of an.

from studylib.net

Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. In this article we have compiled depreciation rates under companies act 2013 under. The depreciable amount of an. The companies act, 2013 provides depreciation rates for. Web depreciation rates under the companies act, 2013. A table is given below of depreciation. Web 127 rows ca sandeep kanoi. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web 129 rows depreciation rates are not given under the new companies act.

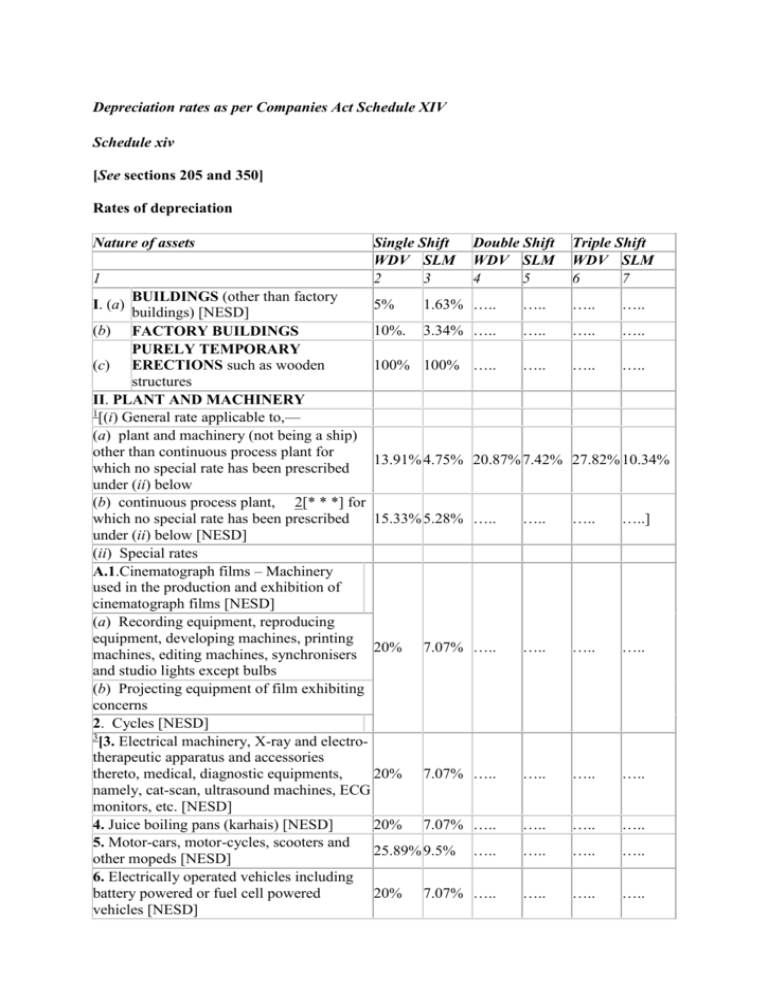

Depreciation Rates

Depreciation Rate On Furniture As Per Companies Act A table is given below of depreciation. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web 129 rows depreciation rates are not given under the new companies act. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. The depreciable amount of an. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Web depreciation rates under the companies act, 2013. In this article we have compiled depreciation rates under companies act 2013 under. A table is given below of depreciation. Web 127 rows ca sandeep kanoi. The companies act, 2013 provides depreciation rates for.

From www.gbu-presnenskij.ru

Calculate Depreciation As Per Companies Act, 2013, 40 OFF Depreciation Rate On Furniture As Per Companies Act Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. The depreciable amount of an. In this article we have compiled depreciation rates under companies act 2013 under. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. A table. Depreciation Rate On Furniture As Per Companies Act.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation Rate On Furniture As Per Companies Act Web 127 rows ca sandeep kanoi. A table is given below of depreciation. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. In this article we have compiled depreciation rates under companies act 2013 under. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule. Depreciation Rate On Furniture As Per Companies Act.

From www.youtube.com

Depreciation Calculator as per Companies Act 2013 Depreciation Depreciation Rate On Furniture As Per Companies Act The depreciable amount of an. Web 127 rows ca sandeep kanoi. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Web depreciation rates under the companies act, 2013. The companies act, 2013 provides depreciation rates for. A table is given below of depreciation. Web companies act 2013 does not provide the rates. Depreciation Rate On Furniture As Per Companies Act.

From www.studocu.com

Depreciation Schedule as per Companies Act 2013 Rate [SLM] Rate [WDV Depreciation Rate On Furniture As Per Companies Act The companies act, 2013 provides depreciation rates for. Web 127 rows ca sandeep kanoi. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. Web 129 rows depreciation rates are. Depreciation Rate On Furniture As Per Companies Act.

From gstguntur.com

Depreciation As Per Companies Act Depreciation Rates and Provisions Depreciation Rate On Furniture As Per Companies Act Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. A table is given below of depreciation. The companies act, 2013 provides depreciation rates for. Web depreciation rates under the companies act, 2013. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c,. Depreciation Rate On Furniture As Per Companies Act.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Depreciation Rate On Furniture As Per Companies Act The depreciable amount of an. Web 129 rows depreciation rates are not given under the new companies act. The companies act, 2013 provides depreciation rates for. Web depreciation rates under the companies act, 2013. Web 127 rows ca sandeep kanoi. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c,. Depreciation Rate On Furniture As Per Companies Act.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Depreciation Rate On Furniture As Per Companies Act Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. In this article we have compiled depreciation rates under companies act 2013 under. The companies act, 2013 provides depreciation rates. Depreciation Rate On Furniture As Per Companies Act.

From newtaxroute.com

Depreciation Rates as per Companies and Tax Act New Tax Route Depreciation Rate On Furniture As Per Companies Act Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. The companies act, 2013 provides depreciation rates for. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web depreciation is the systematic allocation of the depreciable amount of an. Depreciation Rate On Furniture As Per Companies Act.

From accountingtool.in

How to Calculate Depreciation as per Companies Act 2013 AccountingTool Depreciation Rate On Furniture As Per Companies Act Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. The companies act, 2013 provides depreciation rates for. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order,. Depreciation Rate On Furniture As Per Companies Act.

From www.youtube.com

Depreciation Rate chart Depreciation chart as per tax act Depreciation Rate On Furniture As Per Companies Act Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. In this article we have compiled depreciation rates under companies act 2013 under. Web 127 rows ca sandeep kanoi. Web depreciation rates under the companies act, 2013. Web companies act 2013 does not provide the rates of the depreciation, instead it provides,. Depreciation Rate On Furniture As Per Companies Act.

From www.youtube.com

How To Calculate Depreciation Chart as per Tax Rules How To Depreciation Rate On Furniture As Per Companies Act Web 127 rows ca sandeep kanoi. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The companies act, 2013 provides depreciation rates for. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web 129 rows depreciation rates are not. Depreciation Rate On Furniture As Per Companies Act.

From mungfali.com

Depreciation Rate Depreciation Rate On Furniture As Per Companies Act Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The companies act, 2013 provides depreciation rates for. In this article we have compiled depreciation rates under companies act 2013 under. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful.. Depreciation Rate On Furniture As Per Companies Act.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation Rate On Furniture As Per Companies Act In this article we have compiled depreciation rates under companies act 2013 under. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web 127 rows ca sandeep kanoi. The companies act, 2013 provides depreciation rates for. Web depreciation is the systematic allocation of the depreciable amount of. Depreciation Rate On Furniture As Per Companies Act.

From www.professionalutilities.com

Current Depreciation Rates Professional Utilities Depreciation Rate On Furniture As Per Companies Act Web 127 rows ca sandeep kanoi. The companies act, 2013 provides depreciation rates for. Web 129 rows depreciation rates are not given under the new companies act. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Under the companies act, 2013 (2013 act), depreciation accounting assumes a. Depreciation Rate On Furniture As Per Companies Act.

From studylib.net

Depreciation Rates Depreciation Rate On Furniture As Per Companies Act A table is given below of depreciation. Web 129 rows depreciation rates are not given under the new companies act. In this article we have compiled depreciation rates under companies act 2013 under. Web depreciation rates under the companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription. Web. Depreciation Rate On Furniture As Per Companies Act.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation Rate On Furniture As Per Companies Act The companies act, 2013 provides depreciation rates for. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. The depreciable amount of an. Web 129 rows depreciation rates are not given under the new companies act. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new. Depreciation Rate On Furniture As Per Companies Act.

From gstguntur.com

Depreciation Rate Chart as per Companies Act 2013 with Related Law Depreciation Rate On Furniture As Per Companies Act Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Web depreciation rates under the companies act, 2013. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web 127 rows ca sandeep kanoi. A table is given below of depreciation.. Depreciation Rate On Furniture As Per Companies Act.

From www.taxmani.in

Depreciation As Per Companies Act Everything You Need to Know! Depreciation Rate On Furniture As Per Companies Act A table is given below of depreciation. Web companies act 2013 does not provide the rates of the depreciation, instead it provides, in schedule ii part c, the useful. Web depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Web 129 rows depreciation rates are not given under the new companies act. The. Depreciation Rate On Furniture As Per Companies Act.